For quite a few years now (not exactly sure how many), I have had an account with BankDirect for the sole purpose of earning American Airlines miles.

For quite a few years now (not exactly sure how many), I have had an account with BankDirect for the sole purpose of earning American Airlines miles.

Each month I’d earn thousands of AA miles which supplemented the occasional miles earned from credit card sign up bonuses, e-shopping and dining out.

I closed my account a couple of months back since the bank was going to convert all accounts to ones which would eventually no longer earn miles.

For those of you unfamiliar with BankDirect, here’s how the mileage earning accounts worked; Earn 100 AAdvantage miles per month for every $1,000.00 of the average daily collected balance in your Mileage Checking with Interest Account up to the first $50,000.00 on deposit. Average daily balances above $50,000.00 earn 25 AAdvantage miles per $1,000.00 on deposit, with no cap.

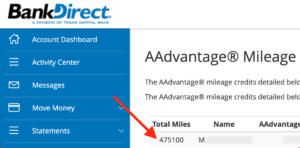

I never really thought about how many miles I’ve earned over the lifetime of my BankDirect account. While looking around online, I saw an option in the dashboard to see just how many miles I had earned.

When I clicked to check I was impressed by how many trips/ flights this account helped us to take! 475,100! That’s a pretty solid amount of miles to earn from a checking account!

475,100! That’s a pretty solid amount of miles to earn from a checking account!

Prior to closing BankDirect, I signed up for an account with Bask Bank, another bank where you can earn American Airlines miles. (Both banks are affiliates of Texas Capital Bank.)

I signed up with a small amount in hopes of earning the sign-up bonus.

If you’d like to earn bonus American Airline miles for opening an account with Bask Bank, you can do so here. (When you deposit $10,000 or more and leave it in the account for 90 days, you’ll earn a bonus of 5,000 miles.)

(FYI- If you use my link to sign up for Bask Bank, I may earn a refer-a-friend bonus.)

That’s nothing. I scored well over a million miles with the old Suntrust debit card that earned miles on DEBIT transactions. I bought $10000 in money orders almost daily on my lunch break from the Walmart next to my office. In fact I just used my last 250k on a trip to Bangkok last year during the Delta Vacation promo. Due to covid they refunded me $5000 voucher. Thinking of a Tahiti redemption instead when I rebook.

How’d your bank do with hundreds of thousands of dollars in money orders a month? From what I read that scale makes banks exceedingly nervous in a post-9/11 world.

I used 4 different banks. I almost always used ATM. Funny part was I was a suntrust employee at that time too. Walmart started making fill out a transaction report then they stopped servicing me. The last 500k or so I was running around to various Walmart’s and post office’s. It got tired but it was a drug. I was addicted to the miles and couldn’t stop. The program eventually changed and that’s how it ended. I was playing with fire but didn’t get burned.

You know it was open secret. Flyer talk would discuss this in the forums. Many people were doing it at large scales. It was so wide spread that Walmart had to change policies on money orders although many employees didn’t follow it. Suntrust didn’t care because transaction fees and deposits they were holding. The loser was walmart. .65 cents a money order and paying the transaction fees on thousands of dollars. A lot of people were run out of the stores. I knew what employee would follow the rules and the ones who didn’t. Eventually you knew what hours a day of the week to go.

If this avoids the nasty tax form at the beginning of the following year, maybe an account that pays miles instead of cash is not such a bad idea. Can you verify that you don’t accrue a tax liability?

Ah Bank Direct! What was great was being able to get Lifetime Platinum with American when they used to count all activity including Bank Direct and Citibank. The glory days. It doesn’t matter now anyway as Platinum doesn’t mean much with American.