For a couple of years I’ve tried unsuccessfully to use my US Bank FlexPerks points while getting max value so I could then close out my card.

For a couple of years I’ve tried unsuccessfully to use my US Bank FlexPerks points while getting max value so I could then close out my card.

I tried and tried but came up empty-handed due to a few reasons. With a shade over 40,000 points in my account, the best way to use my points would be for a plane ticket costing up to $800. Another option was to find two tickets worth up to $400 tickets.

After the first year, the US Bank FlexPerks card charges a $49 annual fee. This is the kind of card I earned the signup bonus on and pretty much tossed into a drawer soon after. (I think I used it to fulfill bonus offers a couple of other times.)

The problem with using my points

Since I typically fly with my family, one $800 ticket isn’t of much use to me. Two $400 tickets would be much more useful. The problem I encountered was finding tickets priced as close as possible to the magical $400 (or $800) price without going over.

When I searched for some destinations, I found the booking portal to not have availability or the flights I wanted. If I did find the flight, it seemed to be pricing out quite high.

My US Bank FlexPerks became a burden and pain…

I couldn’t figure out how to best use my points during the first year so I paid the fee. I then kind of forgot about them for a while. I may have done an award search a couple of times but again couldn’t find anything. However, I did pay the annual fee for a couple of years which definitely ate away at the value of my points.

What to do, what to do???

I had enough and wanted to close my account. I thought about just cashing them in for a gift card but that wouldn’t be a very good value…

An idea, thanks to JetBlue Mosaic status

I did a status match last year and received JetBlue Mosaic status until the end of 2016. (I actually had the status later than expected and just saw it disappear from my account a few days back.)

Having JetBlue Mosaic offers some some solid benefits. During my first flight with the status I got early boarding, free drinks and greetings/ thank you’s from the flight attendants…

One of the more valuable benefits offered with JetBlue Mosaic is that change and cancellation fees are waived for you and others on your itinerary.

Testing out the Be Fee Free benefit

I called up the dedicated JetBlue Mosaic line to find out a bit more about how the free cancellations work. I then explained how I was booking a flight with credit card points. I asked what happened if I had to cancel the flight. I was told that there was no fee and I would receive a Travel Bank credit which would be good for one year.

I then did a search on JetBlue for flights which were as close as possible to $400 or $800.

After a bit of searching, I came up an itinerary for two tickets which came to $768.40.

I then logged into my US Bank FlexPerks account and searched for the exact flights. After finding them, I pulled the trigger and booked the flight for the middle of December.

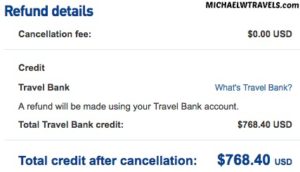

I set an alert on my phone so I wouldn’t forget to cancel the itinerary. Around a week before the date of the flight, I logged in to JetBlue and cancelled the itinerary. This gave me a JetBlue Travel Bank credit for $768.40.

Now I need to decide where to go!

Overall, I’m glad to have finally cancelled my US Bank FlexPerks card. The only issue with my plan is that I now only have one year (less now) to use my credit or I lose it.

I could’ve kept my FlexPerks card open for another year but that would’ve cost me the annual fee $49 or 3,500 points.

In the end I won’t let my JetBlue Travel Bank credit go to waste. I’m just not sure quite yet, what I will use it for.

I love my FlexPerks card. I do all my credit card purchases with it (and pay the balance off monthly to avoid all service/interest charges). The miles pile up fast when using the card, and we have purchased many flights with the points , usually for only 20,000 points or so.

Lee- Thanks and hope you figure something good out with your FlexPerks points!

Great idea on how to work the system. I have a bunch of FlexPerks points from the recent 2016 Olympics offer, but I don’t have status with JetBlue to do the same trick. So, I’ll have to save them for another redemption.