Last week I wrote about how I was having a slower year for credit card churning in 2014. However, another recent 50K approval just helped!

Last week I wrote about how I was having a slower year for credit card churning in 2014. However, another recent 50K approval just helped!

With limited new credit cards to apply for and also trying to limit the amount of Chase cards I go for, I turned to a familiar friend- Citi.

A 50,000 AAdvantage bonus miles offer was enough to entice me to apply for the Citi AAdvantage Platinum Select Mastercard. Not only does this card come with bonus miles, it also includes 2 Admiral’s Club Passes, group 1 boarding, free first checked bags for up to 4 people and more.

After happily posting about my new Citi AA card approval, a few readers commented that I might not be eligible for the bonus due to currently having the Citi AAdvantage Executive card. (I personally have 3 which each came with a 100,000 miles bonus.)

I sure hoped this wasn’t the case as I’d hate to waste a credit card pull for nothing. (If I wasn’t eligible for the bonus, at best it would be a valuable lesson to be sure to read the terms of new credit card offers before applying in the future.)

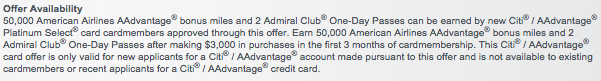

Here is the Offer Availability taken from the card application:

According to what’s written above (“not available to existing cardmembers“) it was definitely cause for worry. It was unclear to me if the Citi AA Executive cards were considered the same product thus making me an existing cardmember?

I was looking forward to the arrival of my new card which showed this past Monday.

I immediately called in to find out what my offer was prior to activating the card.

After a brief hold I spoke with a very friendly representative. After asking about the perks associated with my card I was happy to hear some beautiful words. “If you spend $3,000 within the first 3 months, you’ll earn 50,000 bonus miles”. She then went on to tell me about the other perks I could get from the card.

So to those of you wondering if the Citi AA Executive card makes you ineligible for this new 50K AAdvantage offer, it looks like the answer is no it does not.

I’ll be working towards completing the $3,000 spend and expect the bonus miles to post to my account without a problem. I just hope that it doesn’t become a battle for the bonus like it was with my Amex Platinum Card back in 2013.

Have you been hesitant to apply for the Citi AA 50K offer due to having the Citi AA Executive Card?

Heather- I wish I had an answer for you but I don’t. When I applied I got the message to call in for a decision. I called in and was approved within minutes. Once I received my new card, I called before activating and asked for a rundown of perks/ bonuses and was told of the 50k bonus along with lounge passes etc…

I know in the past some got denied for new AA Citi cards due to having or had them while others didn’t…

kamal- Interesting. Up until this card, my most recent Citi AA Exec approval was in June.

Scott- I can’t recall the last time I haven’t had multiple Citi AA cards. When the fees come up for my Exec Cards, that will be easy- close them! I am no way paying $450 per card to keep any of them open. I can’t recally ever having a Citi rep mention my other cards when closing an account so I would not expect that to change or be something to worry about. As for a post about closing my Exec Cards- I’ll see if one is warranted when the time comes (which should be coming up soon).

I have 2 of the 100k Citi AAdvantage Exec cards (so does my wife!) and I am considering applying for this 50k card. Just curious, how are you going to handle canceling the Exec cards when the annual fees come due? I have never held multiple cards like this before. When you call them, do you expect the rep to say “hmmm, I see you have 3 of these cards…” I’d love to see a post on your strategy for this.

My wife was declined for Citi AA Platinum card few weeks back. Not sure if something changed recently. She was given the reason that she already earned bonus recently(She had applied for Citi Executive few months back and got the 100K bonus)

But does having a AA Platinum Select disqualify you? That’s the answer I got from citi during my last app round (two days ago). I called after being told that I would have a decision in 2 weeks (never a good sign) and the rep said that I was being denied for having the same product. I also have two AA Execs.

Fluke or am I just out of luck?