With all of the chatter related to the increased bonus offer for the Ink cards last month I decided it was time to apply for another card issued by Chase.

With all of the chatter related to the increased bonus offer for the Ink cards last month I decided it was time to apply for another card issued by Chase.

After having so many cards from the bank over the years, I try to be a bit more selective when applying for cards issued by them. When a 60,000 points signup offer came out for the Ink products, I figured the additional 10,000 bonus points was enough to get me to bite.

I currently have 5 Chase cards- British Airways, IHG, Ink Bold, Sapphire & United. I didn’t expect an instant approval but was confident that I could get approved if I needed to call the retention line.

After completing my application, I eagerly awaited a response. After around two minutes, the result came back as (something like) pending further review. I decided to hold off on calling in since it was already the weekend. I figured that I could wait a few days and then try giving them a call.

When Monday came I was debating whether or not to call when I got home from work. However, there was no need to bother.

While checking my e-mail, I received a message with a great subject: You’ve been approved! Welcome to Ink Plus.

After cashing out most of my United miles over the past two summers (Southeast Asia & Balkans trips), these miles will help to replenish my account.

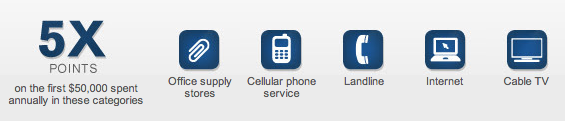

With my new Ink Plus approval I planned to put one of my favorite cards, the Ink Bold in my pile of cards not to use. Since having the card I’ve loved taking advantage of the 5X points earning at office supply stores and when paying cable, internet & phone bills.

While going over my Ink Bold statement, I noticed that the $95 annual fee had just posted. Now I never like to pay fees to hold onto cards but it got me thinking. Had I not been approved for the Ink Plus card, I probably would’ve kept the card. For $95, the ability to earn 5X points is a small price to pay.

However, with my new approval, the timing couldn’t be much better. Do I really need to hold onto two Ink cards? I think it’s an easy decision. I’ll be sad to see it go but the Ink Bold will be getting canceled unless Chase wants to make me an offer that I just can’t say no to.

Would you consider paying the fee to hold onto both Ink cards or do you think one is enough? If we had Walmart closer to home and it was easier to transfer gift cards to my Bluebird I could see the argument for keeping both cards to maximize the 5X points category.

Sandy- Thank you! A couple of years back I had to make multiple calls before getting approved for a 2nd British Airways 100K offer. (I had the original offer a couple of years prior to this.) During the call, they suggested that I not apply for a Chase card for a while so I focused on other banks. I closed a bunch of Chase cards that I no longer needed and transfered the credit lines over to other cards. I try to be selective on which Chase cards I apply for still to this day.

Alex- Good to know. I have to call Chase and see what they offer me!

I had the same thing happening last year. I decided to call Chase and closed one of the Ink accounts. The agent offered to waive the annual fee.

Congrats on getting your second Ink! And thanks for this post. It seems like not calling into the recon. line may have a better chance of getting approved. I think I’ve been reading too many posts on flyer talk about a CSR, Jason, that answers recon. lines.

I got denied trying to get chase southwest plus business the las time I applied and they did give me a hard time about having sapphire, united mileage plus card and the southwest (all personal). I tried telling chase I only have AMEX business cards and would like to have a business visa or MC…they recommended me to apply again 6 months later. However, I haven’t yet because I was kind of afraid and dis encouraged.